Inventory turnover

| Accountancy | |

|---|---|

| Key concepts | |

| Accountant · Accounting period · Bookkeeping · Cash and accrual basis · Cash flow forecasting · Chart of accounts · Journal · Special journals · Constant item purchasing power accounting · Cost of goods sold · Credit terms · Debits and credits · Double-entry system · Mark-to-market accounting · FIFO and LIFO · GAAP / IFRS · General ledger · Goodwill · Historical cost · Matching principle · Revenue recognition · Trial balance | |

| Fields of accounting | |

| Cost · Financial · Forensic · Fund · Management · Tax (U.S.) | |

| Financial statements | |

| Balance sheet · Cash flow statement · Statement of retained earnings · Income statement · Notes · Management discussion and analysis · XBRL | |

| Auditing | |

| Auditor's report · Financial audit · GAAS / ISA · Internal audit · Sarbanes–Oxley Act | |

| Accounting qualifications | |

| CA · CPA · CCA · CGA · CMA · CAT · CFA · CIIA · IIA · CTP · ACCA |

In accounting, the Inventory turnover is a measure of the number of times inventory is sold or used in a time period such as a year. The equation for inventory turnover equals the cost of goods sold divided by the average inventory. Inventory turnover is also known as inventory turns, stockturn, stock turns, turns, and stock turnover.

Contents |

Inventory Turnover Equation

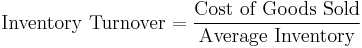

The formula for inventory turnover:

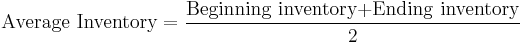

The formula for average inventory:

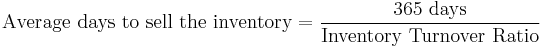

Alternatively, the average days to sell the inventory may also be calculated as follows:[1]

Application in Business

A low turnover rate may point to overstocking[2], obsolescence, or deficiencies in the product line or marketing effort. However, in some instances a low rate may be appropriate, such as where higher inventory levels occur in anticipation of rapidly rising prices or shortages. A high turnover rate may indicate inadequate inventory levels, which may lead to a loss in business. Assume cost of sales is $70,000, beginning inventory is $10,000, and ending inventory is $9,000. The inventory turnover equals 7.37 times ($70,000/$9500).

Some compilers of industry data (e.g., Dun & Bradstreet) use sales as the numerator instead of cost of sales. Cost of sales yields a more realistic turnover ratio, but it is often necessary to use sales for purposes of comparative analysis. Cost of sales is considered to be more realistic because of the difference in which sales and the cost of sales are recorded. Sales are generally recorded at market value, i.e. the value at which the marketplace paid for the good or service provided by the firm. In the event that the firm had an exceptional year and the market paid a premium for the firm's goods and services then the numerator may be an inaccurate measure. However, cost of sales is recorded by the firm at what the firm actually paid for the materials available for sale. Additionally, firms may reduce prices to generate sales in an effort to cycle inventory. In this article, the terms "cost of sales" and "cost of goods sold" are synonymous.

An item whose inventory is sold (turns over) once a year has higher holding cost than one that turns over twice, or three times, or more in that time.Stock turnover also indicates the briskness of the business. The purpose of increasing inventory turns is to reduce inventory for three reasons.

- Increasing inventory turns reduces holding cost. The organization spends less money on rent, utilities, insurance, theft and other costs of maintaining a stock of good to be sold.

- Reducing holding cost increases net income and profitability as long as the revenue from selling the item remains constant.

- Items that turn over more quickly increase responsiveness to changes in customer requirements while allowing the replacement of obsolete items. This is a major concern in fashion industries.

However high turns may indicate that the inventory is too low. This often can result in stock shortages.

- When making comparison between firms, it's important to take note of the industry, or the comparison will be distorted. Making comparison between a supermarket and a car dealer, will not be appropriate, as supermarket sells fast moving goods such as sweets, chocolates, soft drinks so the stock turnover will be higher. However, a car dealer will have a low turnover due to the item being a slow moving item. As such only intra-industry comparison will be appropriate.

Note

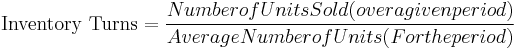

Some computer programs measure the stock turns of an item using the actual number sold.

In practice this tends to be confusing and can give misleading results if averaged out over a department.

Also, stock turn rates are sometimes based on annual sales at retail divided by average inventory at retail. This measurement, sometimes available in computer systems, is based on the value that your customer perceives the product has (actual selling price which may include markdowns) and the value of your inventory. These computer systems can devalue inventory as markdowns occur even before they are sold. One valid reason for using retail for these calculations is that if a $100 retail-priced item (that was $50 at cost) is now only worth $80, then the retailer would find it difficult to pay $50 for an item only worth $80 to customers.

Retail-calculated stock turns rates tend to be lower than those calculated at cost.

The important issue is that any organization should be consistent in the formula that it uses.

See also

References

- ^ Weygandt, J. J., Kieso, D. E., & Kell, W. G. (1996). Accounting Principles (4th ed.). New York, Chichester, Brisbane, Toronto, Singapore: John Wiley & Sons, Inc. p. 802.

- ^ Commercial Loan Analysis: principles and techniques for credit analysts and lenders By Kenneth R. Pirok ISBN 1557387168

Further reading

- Business Mathematics, 10th Edition, Chapter 7, § 4, ISBN 0321277821